If you are attempting to calculate the mortgage payments for a FHA loan availed earlier, then you may have to override the defaults provided by the calculator. This calculator assumes that the Upfront MIP is rolled into the mortgage. number of payments over the loan’s lifetime Multiply the number of years in your loan term by 12 (the. The rules, to calculate the value and duration of MIPs, are complex and have changed over the years. If your interest rate is 5 percent, your monthly rate would be 0.004167 (0.05/120.004167). Quickly see how much interest you could pay and your estimated. FHA requires one-time UFMIP and recurring MIP (similar to Private Mortgage Insurance - PMI - with Conventional Loans) based on loan-to-value (LTV), your credit score, amortization period, refinance or purchase etc. Use this calculator to generate an estimated amortization schedule for your current mortgage. A mortgage amortization calculator shows how much of your monthly mortgage payments goes toward principal (the money you borrowed), and how much goes toward interest.Currently, FHA mandates a minimum 3.5% down payment towards your house.

Choose what you want to calculate and compare different scenarios. You should lookup county-level FHA loan limits for your State and enter the home value accordingly. Our mortgage calculator works as a payment, amortization or mortgage amount calculator.

MORTGAGE CALCULATOR AMORTIZATION FULL

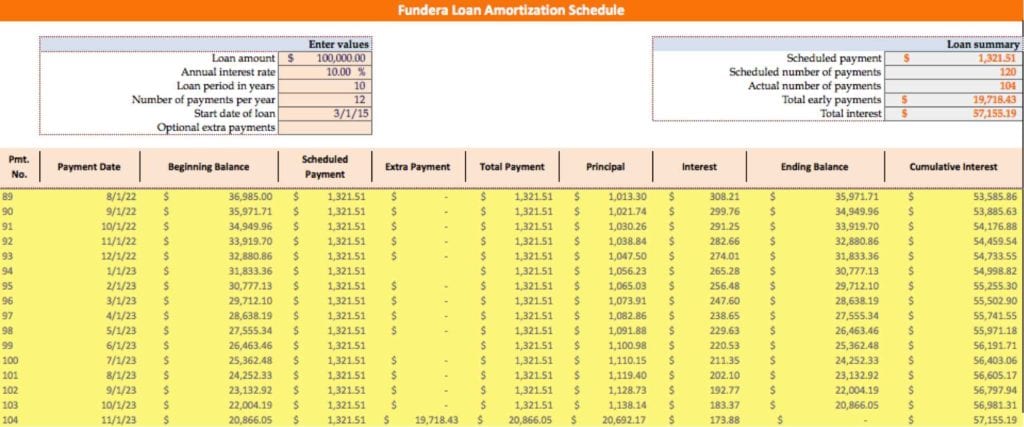

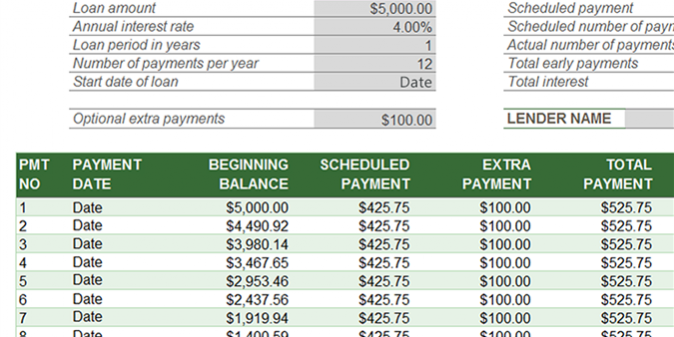

Because of FHA’s low down payments and small reserve requirements, along with options to roll up-front mortgage insurance into the loan, many buyers find they can get into an FHA loan and onto the road to homeownership much more quickly than they can with traditional loan products. Amortization can only be entered in full years (not months or partial years) Mortgage amount is rounded to the nearest 1,000 A minimum 5 down payment is. However, compared to other loans, FHA is much more forgiving of your liquidity-related woes. That’s not a judgement statement - we all start somewhere. Common example of the amortization process is a mortgage loan, personal loan or car loan and it is one of the simplest and most used loan repayment models today.First time homebuyers, more than any class of homeowners, tend to be cash poor. Having such knowledge gives the borrower a better idea of how each payment affects a loan. It also calculates the monthly payment amount and determines the portion of one's payment going to interest. Each of these regular periodic payments consist of principal and interest as well. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. These repayment installments are determined by an amortization schedule (also known as amortization table or amortization chart). The loan amortization calculator is useful for borrowers to see how much interest and principal they are paying each month. Quickly see how much interest you could pay. Amortization Calculator is used to calculate monthly payment and generate loan amortization for your loan. In our case it means the payment of a loan in multiple installments. Use this mortgage calculator to determine your monthly payment and generate an estimated amortization schedule. How can an amortization calculator help you?Īmortization is the process of reducing an amount over a given time period. Common example of the amortization process is a mortgage loan, personal loan or car loan and it is one of the simplest and most used loan repayment models today. Each of these regular periodic payments consist of principal and interest as well. In our case it means the payment of a loan in multiple installments. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.Īmortization is the process of reducing an amount over a given time period. Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

0 kommentar(er)

0 kommentar(er)